Source: Streetwise Reports

September 1, 2021 (Investorideas.com Newswire) Gatling Exploration's CEO, Jason Billan, answers the big questions about the company's high-grade gold deposit in Ontario.

On August 6, 2021, Gatling Exploration Inc. (GTR:TSX.V; GATGF:OTCQX) published an update on the ongoing drill program at the Larder Gold project in Ontario, Canada. These latest results will feed into a mineral resource estimate, scheduled for Q3 2021.

Larder Project Highlights

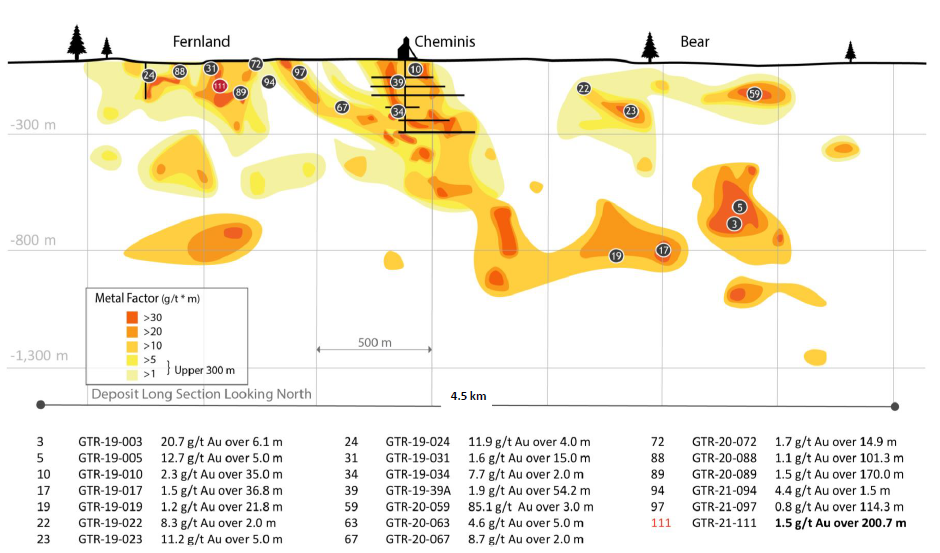

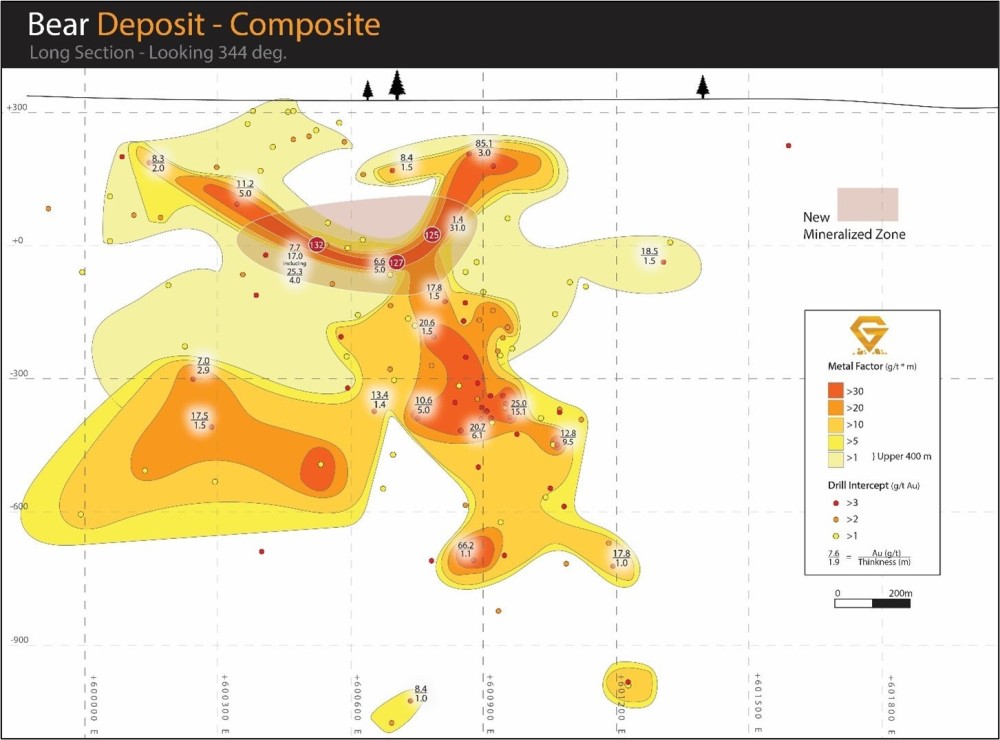

"Drilling at the Bear deposit has returned 7.7 g/t Au over 17.0 m including 25.3 g/t Au over 4.0 m up plunge from the core of the Bear deposit, connecting it to near-surface lenses identified in Gatling's 2019 drill campaign," Gatling reported.

Streetwise Reports caught up with Gatling CEO Jason Billan last week. We kicked off the conversation by asking about his background.

In 2009, Billan completed an MBA at the University of Western Ontario.

The financial crisis "was a good time to study the business world," Billan recounted. "I got interested in gold as a commodity and safe haven, and this propelled me into the mining sector."

Billan worked in equity research, covering a broad universe of small caps, including precious metals. He spent a year at Salman Partners, then moved to RBC Capital Markets. In 2012, he joined Nevsun Resources in corporate development — which sold to China's Zijin Mining in 2018 for $1.8 billion.

In 2019, Billan joined Gatling's board, and later was asked to be the CEO.

We asked Billan for a "bird's-eye view" of Gatling's resources.

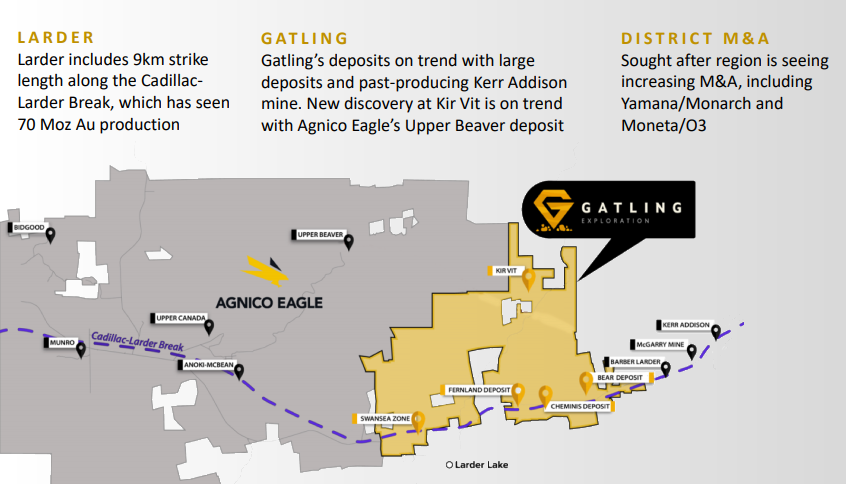

"Gatling owns a large gold project located in the Abitibi greenstone belt," explained Billan. "We're sitting on one of the east-westerly faults, 35 kilometers east of Kirkland Lake and about seven kilometers west of the old Kerr Addison mine."

Straddling the provinces of Ontario and Quebec, Canada's Abitibi greenstone belt is a 450-kilometer-long by 150-kilometer-wide mineral-rich geological belt.

In the last 120 years, it has yielded 180 million ounces of gold. At least 15 mines have produced more than 100 tonnes of gold.

In the Abitibi greenstone belt, clusters of gold deposits typically occur close to major structural breaks.

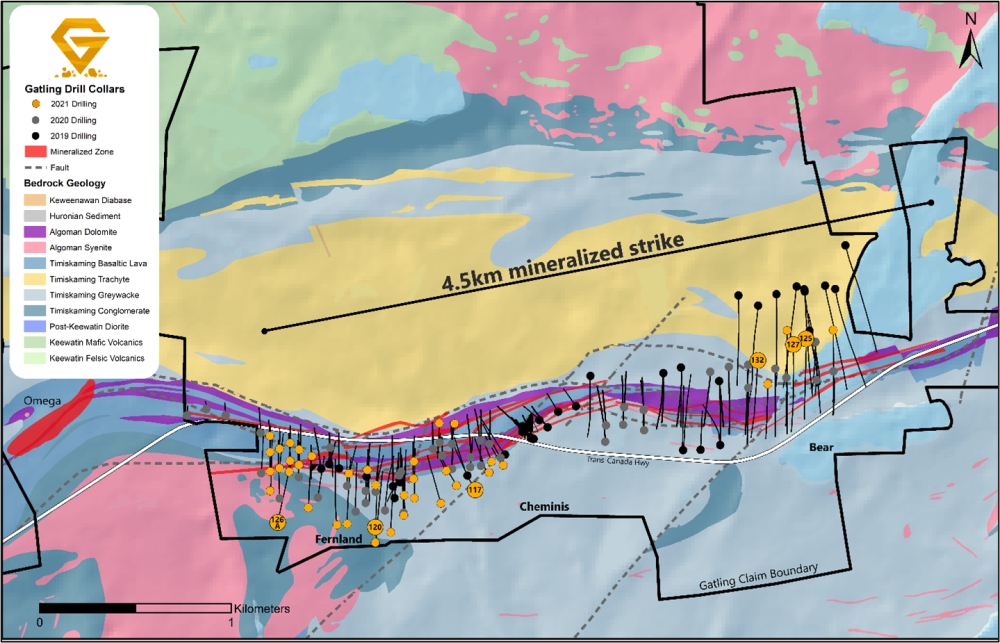

"Our three main deposits cover a 4.5-kilometer strike," stated Billan. "They're on the southeastern portion of our land package. In addition, we acquired the remaining 25% on the southwestern side of our property, spanning another 4.0 kilometers of strike, a couple months ago at competitive pricing."

In the past, these three deposits were considered to be distinct underground projects, but Billan's geo team is exploring the possibility of combining the three adjacent deposits.

"The Bear deposit has been established as the deepest of the three deposits, with the majority of gold ounces beginning around 500 meters below surface," explained Billan. "Above this level, we hit in a gap, which is 350 meters [in strike] by 150 meters vertical. One of the objectives of this current 25,000-meter drill program was to fill that gap, and these results will be incorporated into the resource update."

"We've had a 20 gram per tonne gold hit over six meters, around 800 meters below surface," continued Billan. "We've hit as deep as 1.3 kilometers below surface at Bear. The systems in our region, like Kirkland Lake, are all multi-kilometer-deep systems. Kirkland Lake is running two kilometers below surface. So the potential for further mineralization at depth is significant."

August 6, 2021, Gatling Bear Drill Update Highlights

"The central deposit of the three is called Cheminis," Billan told Streetwise. "It has historical workings down to 330 meters. The underground workings are flooded, but could be de-flooded in a development scenario. Cheminis was mined in the '90s. So we're not talking about a century-old mine-workings. From our preliminary assessments, the workings are in decent condition."

"Looking at the same underground working level, heading east you hit the beginning of the Bear system just 120 meters away," Billan added. "You could potentially drive towards the Bear deposit, then decline, so you wouldn't necessarily have to sink a shaft. There are a couple of different scenarios where we can leverage Cheminis infrastructure to access the Bear deposit."

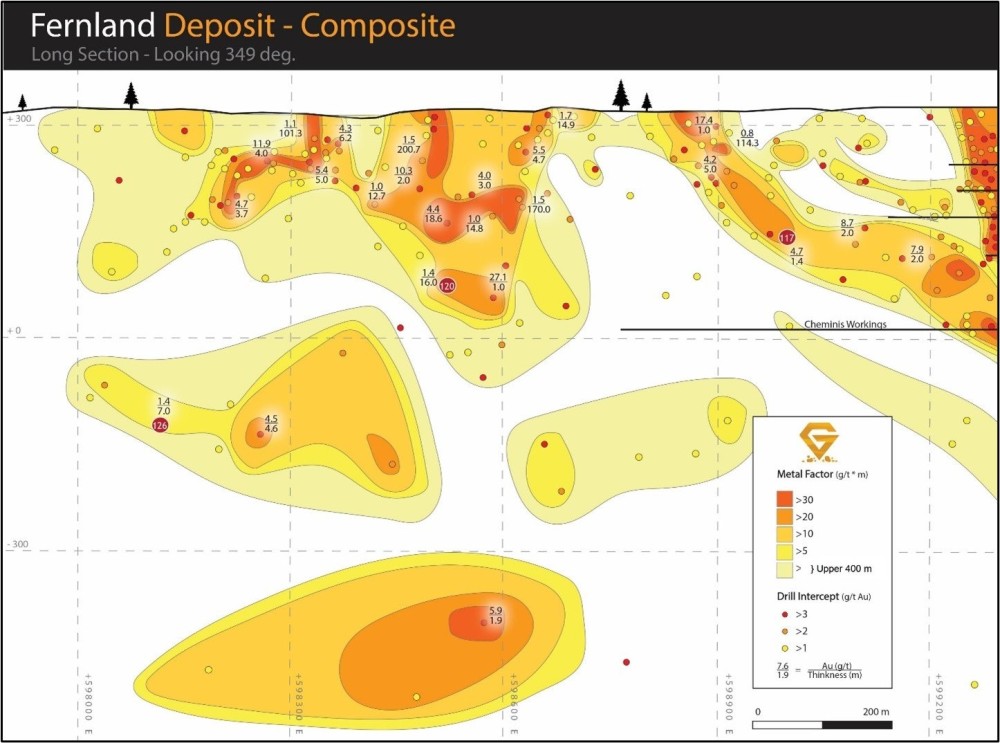

The August 6, 2021, press release confirms that 13,500 meters of drilling have been completed on the Fernland deposit, targeting near-surface gold mineralization, and that "recent drilling from all three zones has added to both open pit and underground resource potential."

"Gatling has now entered the resource update phase utilizing its large drill database highlighted by more than 60,000 m of drilling completed by the Company across all three high-grade gold deposits over the past 2.5 years, plus 70,000 m of historical drilling, including 37,000 m to support Fernland's initial resource estimate," according to the release.

"The 25,000-meter exploration program outlined at the beginning of the year is nearly 90% complete and has continued to deliver impressive results across the Fernland and now Bear deposits, which bode well for the upcoming mineral resource estimate at the Larder project," stated Billan.

August 6, 2021, Fernland Drill Update Highlights

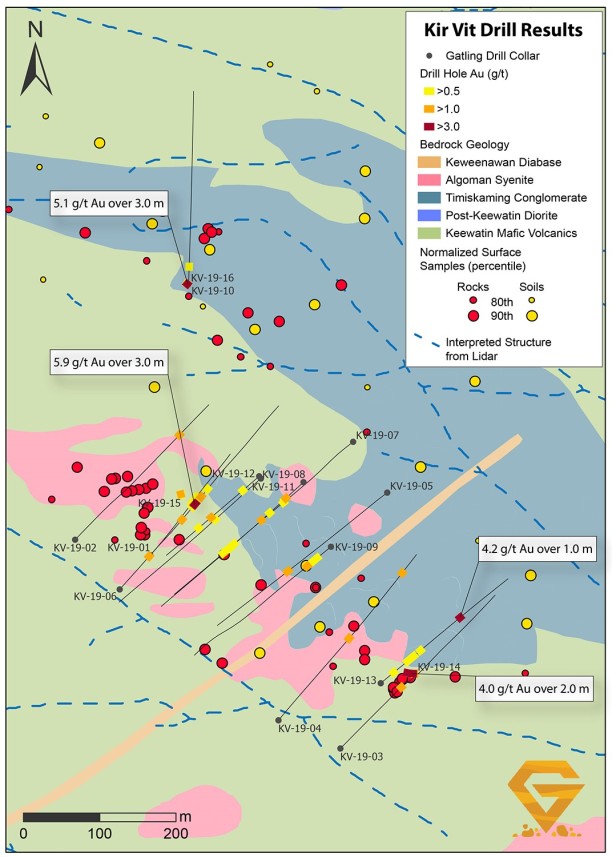

"Our number one prospect off the break, six kilometers north of this region, is called Kir Vit," Billan told Streetwise. "Last year's channel-sampling program was successful, returning 16 grams of gold over a meter, as well as 2.8 grams of gold over seven meters."

"We've been drilling there since late June, 2021," continued Billan. "We're excited to see what this could ultimately be. Kir Vit is on trend with Agnico Eagle's Upper Beaver deposit, which is six kilometers to the west. Upper Beaver currently contains roughly 1.4 million ounces of gold reserves at roughly five grams per tonne. It also has a 0.25% copper kicker."

"Agnico Eagle is planning to be in production next door to us by 2027," added Billan, "producing 180,000-240,000 ounces of gold per year, at all-in sustaining costs of roughly $750 an ounce. This is welcome news for Gatling management and shareholders."

We asked Billan about his views on gold as an investment vehicle.

"We are quite likely in a situation of [quantitative-easing] infinity; inflation is running well-above Fed target levels," responded Billan. "At some point, the Fed will hit a wall — how do they normalize the economy when financial markets have become increasingly sensitive to tightening, whether it be the taper or modest rate increases? We believe gold will have its moment, and when it does, it could be very profitable to own gold in the ground."

Management and key insiders own about 2% of Gatling. There are 45.3 million shares outstanding; 52.3 million are fully diluted. Current market cap is about CA$16.9 million. After participating in the last financing, two institutional investors also own between 5 and 15% of the company. In addition, numerous high-net-worth and family office investors have long-term positions in Gatling. The shares left in the public float are tightly held.

Disclosure:

1) Guy Bennett compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor/employee. He or members of his household own securities of the following companies mentioned in the article: None. He or members of his household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Gatling Exploration Inc. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Gatling Exploration Inc., a company mentioned in this article.

More Info:

Disclaimer/Disclosure: Investorideas.com is a digital publisher of third party sourced news, articles and equity research as well as creates original content, including video, interviews and articles. Original content created by investorideas is protected by copyright laws other than syndication rights. Our site does not make recommendations for purchases or sale of stocks, services or products. Nothing on our sites should be construed as an offer or solicitation to buy or sell products or securities. All investing involves risk and possible losses. This site is currently compensated for news publication and distribution, social media and marketing, content creation and more. Disclosure is posted for each compensated news release, content published /created if required but otherwise the news was not compensated for and was published for the sole interest of our readers and followers. Contact management and IR of each company directly regarding specific questions.

More disclaimer info: https://www.investorideas.com/About/Disclaimer.asp Learn more about publishing your news release and our other news services on the Investorideas.com newswire https://www.investorideas.com/News-Upload/

Global investors must adhere to regulations of each country. Please read Investorideas.com privacy policy: https://www.investorideas.com/About/Private_Policy.asp